Last Minute Tax Tips and Resources in Edmonds

While the winter storms we experienced this year may have made February feel like a lost month, unfortunately the IRS doesn’t allow for snow days. Tax season is here again and this year we are held to the traditional April 15th deadline which falls on a Monday this year.

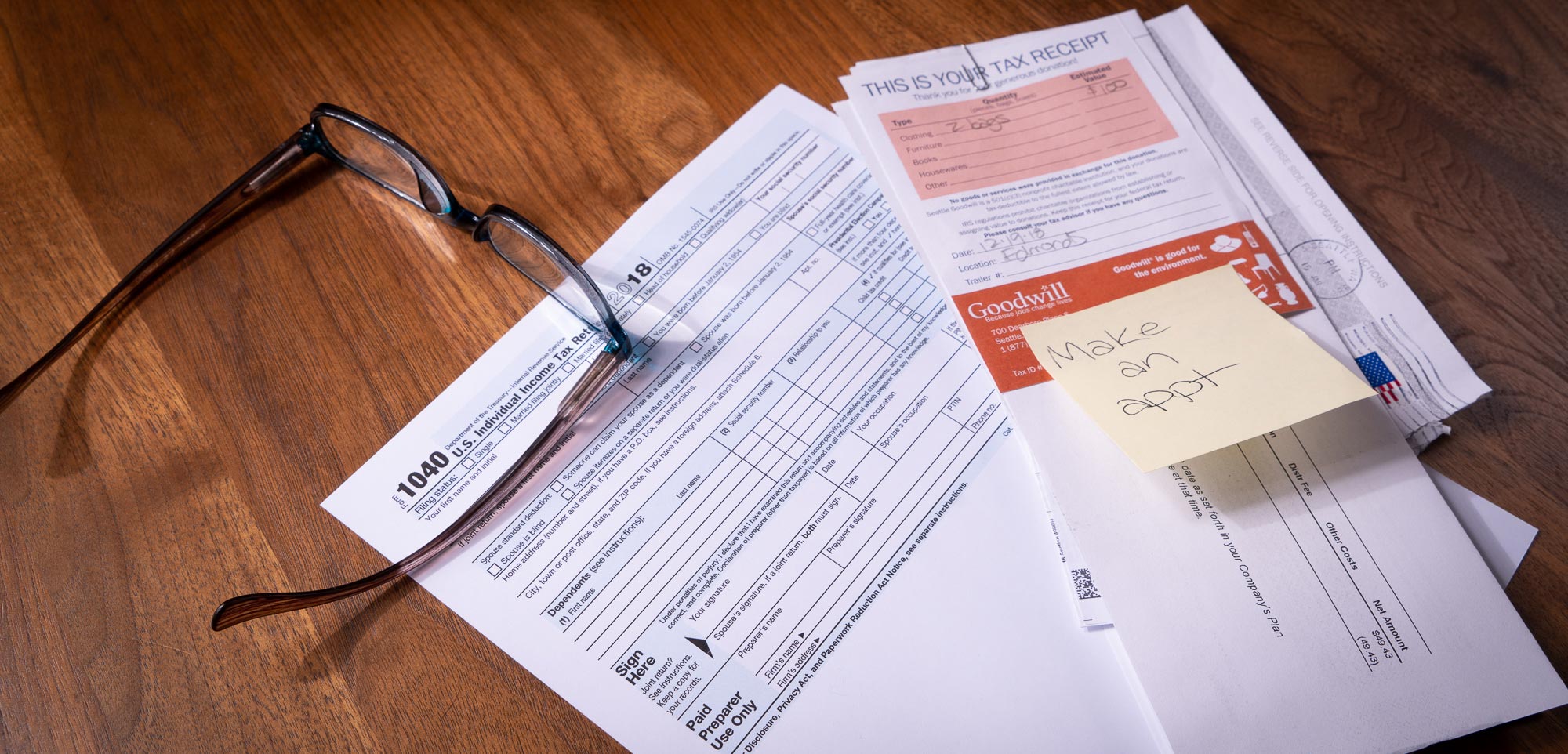

Here are some last minute tax tips to help you meet the deadline and hopefully relieve some stress if doing your taxes is something that you’ve put off until now.

Do it yourself or hire a pro?

For many people, it is not too cumbersome to prepare and file your own taxes using a resource like TurboTax. This is especially true if your filing as an individual earning under $200,000, did not have a major change in life circumstance (marriage, divorce, new baby), and don’t have investment income or significant charitable donations.

If you prefer the peace of mind with having a professional assist you, it’s not too late to hire their services. While it’s definitely their busiest season and you may not get your first choice of appointment time, it’s still a service available to you. There are many financial and accounting firms in Edmonds who offer tax preparation as part of their services. You can see them all listed on our website by clicking right here.

Account for all your tax information in your filing

An important tip from Nancy Duffy of McDevitt & Duffy, CPAs is to remember that “all of the tax information forms that you receive (W-2’s, 1099’s etc) are also sent directly to the IRS. If the information on your tax returns is different from these forms, you can expect a letter from the IRS. So double check the numbers before you file and save yourself the headache of having to reply to the IRS.”

Chris Fleck of Puget Sound Tax Services also points out that you may not receive a paper copy mailed to you of the forms filed with the IRS. You can download them all yourself to see what’s been filed with the IRS by requesting your transcript which is a free service.

How the Tax Cuts and Jobs Act of 2017 affects your 2018 taxes

Passed in 2017, the new TCJA law went into effect on January 1, 2018. Some of the biggest changes that could affect what you pay or what you may receive as a refund include:

• Limits on deductions for things like property taxes, mortgage interest, interest on home equity loans, charitable donations

• Personal and dependent exemptions have been eliminated

• Higher tax credits for families with children and an increase to the standard deduction

Bottom line: don’t be surprised if your 2018 filing looks different than your 2017 filing, even if you didn’t have any significant changes to your income or number of dependents.

Check your refund status

The IRS has a great online tool that allows taxpayers to see the status of their anticipated refund. The system is updated daily so the information is quite current. The IRS says that most refunds are processed within 21 days for e-filers and six weeks for mailed returns, however, we have heard some people have been experiencing longer wait times this year. If your refund has taken longer than normal, or if the system indicates, you may call the IRS directly to inquire.

Filing an extension

If you simply aren’t able to complete your filing by the April 15th deadline, it is possible to file for an extension with the IRS. You can e-file your extension free of charge, however, the IRS does require that you still pay the estimated amount you may owe by April 15th. The forms and more information is available on their website.

Planning ahead

Most tax professionals we spoke to recommend starting the tax process well before the end of the calendar year, especially if you hire someone to assist you. This gives your tax pro ample time to evaluate your individual situation, potentially earn you tax savings, and create a strategy for the upcoming year as well.